INVOICE FINANCING

For SMEs issuing Invoices with credit terms of 30 - 150 daysPURCHASE ORDER FINANCING

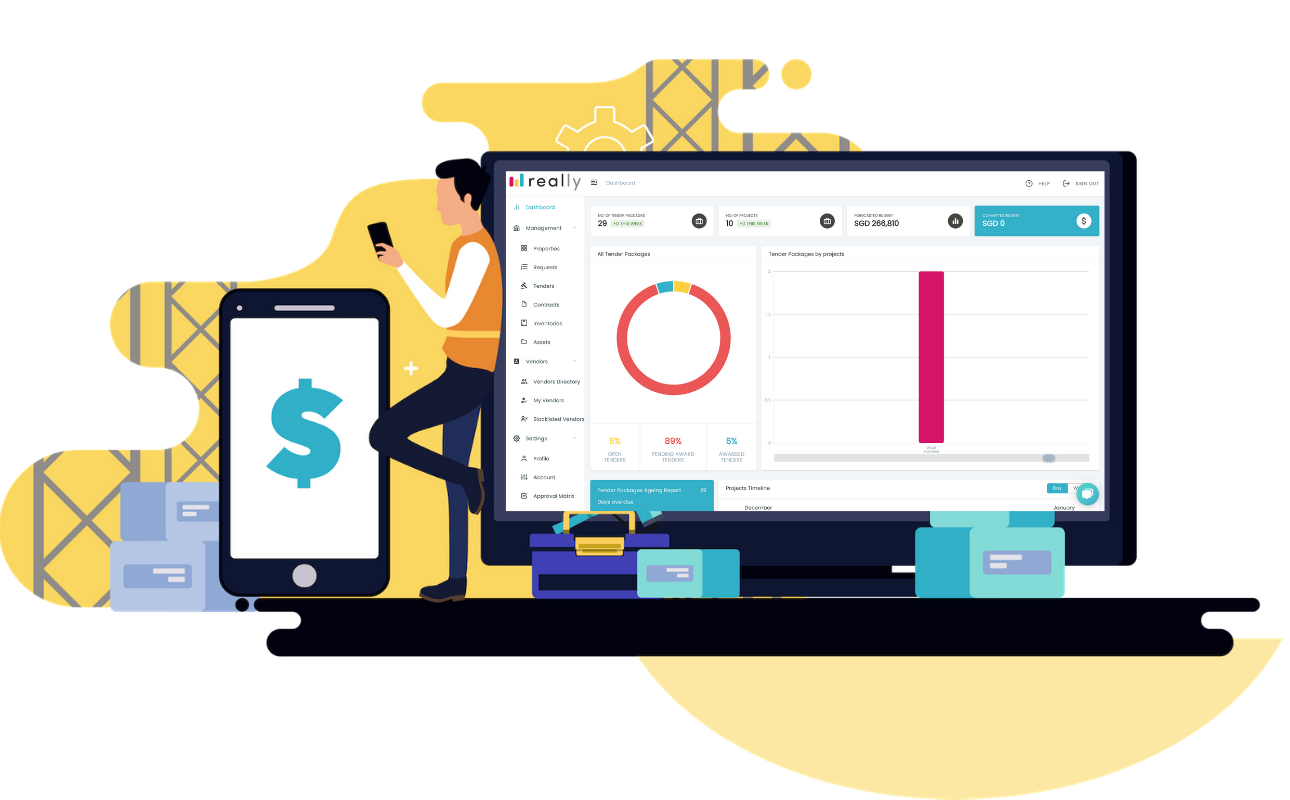

For SMEs with large orders or contractsBest suited for vendors, suppliers, contractors and property managers in Singapore

- Equipment Supply

- Facility Maintenance

- Property Management

- Property Construction

- Property Renovation and/or Fit-out

- Asset Enhancement Initiatives

Increase business cashflow

Access extra financial support

Fulfil growing orders & demand

Expand and grow your business

Really has partnered with Validus to help SMEs in Singapore access funds easily and affordably. Vendors on the Really platform could be approved for up to *$50,000 in funding in as little time as 48 hours.

*T&Cs apply.

Read brochure

Read brochure

Frequently asked questions

Exclusive Offer Terms and Conditions

*Subject to a maximum financing amount of $500,000 for Invoice Financing, and $250,000 for Purchase Order Financing. Rates published are only applicable to projects of Tenders won on the Really platform, and only if the MCST (Buyer) has signed an Notice of Irrevocable Payment (NIP) to redirect invoice(s) payment for goods and services by SME Borrower, to Validus Capital.

Information provided is intended as a guide only, and does not constitute a loan application or an offer of finance. Rates may vary and any finance or loan request is subject to assessment by Validus Capital. Really reserves the right to update the information without prior notice.